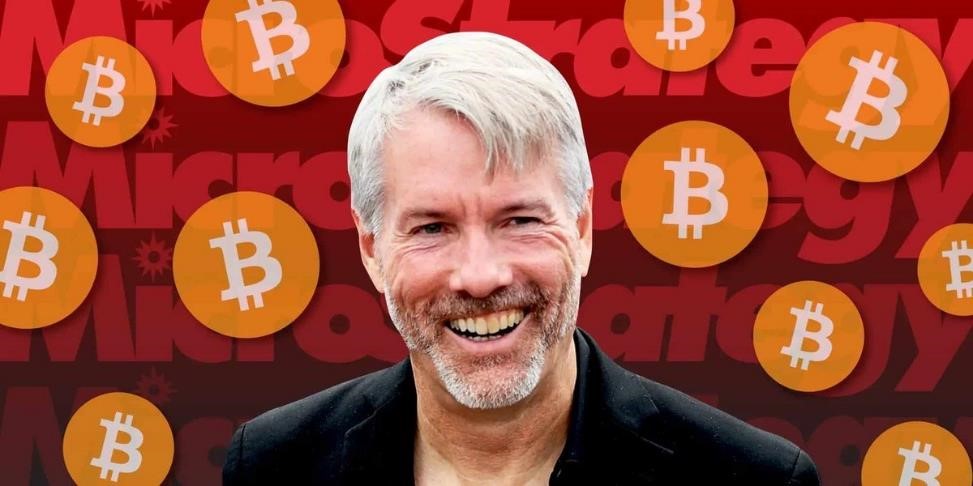

In a recent interview on Bloomberg, Michael Saylor, co-founder and executive chairman of MicroStrategy, expressed his belief that the approval of a spot Bitcoin ETF could be a game-changer for the cryptocurrency landscape in 2024. According to Saylor, this development could unleash a significant surge in demand for Bitcoin, potentially leading to dramatic price increases.

Saylor argued that a spot Bitcoin ETF would offer mainstream investors their first “high bandwidth compliant channel” to access Bitcoin, projecting a potential “2 to 10x increase in demand.” Simultaneously, Bitcoin’s supply is expected to tighten further in April due to its halving event, reducing the new supply generated by miners by half.

Anticipating a major bull run for the asset class in 2024, Saylor emphasized the uncertainty about the extent of Bitcoin’s surge but indicated optimism about prices going “higher” with increased demand and reduced supply.

According to Saylor, the approval of a spot ETF would be a landmark event on Wall Street, comparable to the creation of the first S&P 500 index fund in 1993, which provided mainstream investors with effortless exposure to the broad stock market. In closing, Saylor noted that MicroStrategy plans to leverage cash flows to expand its Bitcoin holdings rather than liquidating to invest in a spot ETF, aligning with their commitment to Bitcoin accumulation strategies. Stay tuned for updates on this potential catalyst for a major bull run in the crypto market come 2024.