Weekly Analysis

Weekly Analysis

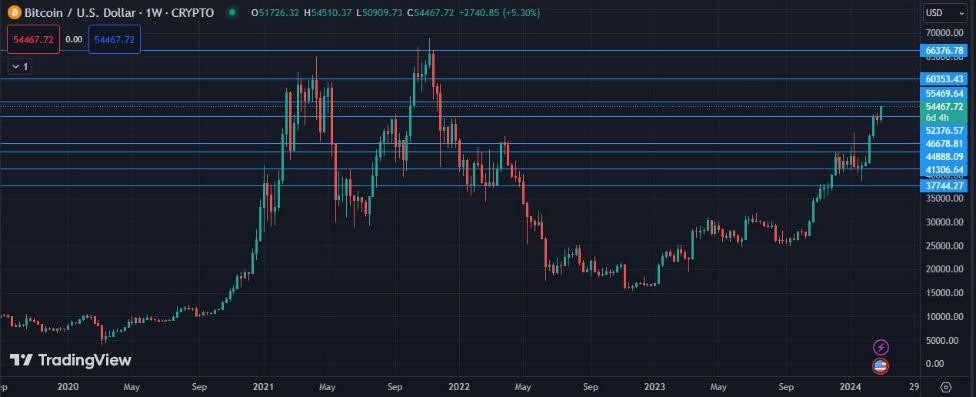

Bitcoin

Bitcoin (BTC) surged past the $53,000 mark on Monday, reaching its highest price since November 2021 and breaking out of its recent sideways trading range. Analysts at Swissblock suggest that this breakout could propel Bitcoin to target $58,000 as momentum picks up in the cryptocurrency market.

The sudden rally in Bitcoin saw it surpass $53,600 during mid-morning U.S. trading hours, marking a 3.8% increase over the past 24 hours. This bullish move also lifted the broader crypto market, with the CoinDesk20 Index (CD20) climbing 2.3% and surpassing the 2,000 level for the first time.

Ether (ETH), the second-largest cryptocurrency, joined in on the rally, surging nearly 4% to reach $3,150, its highest price in 22 months. The overall sentiment in the market is one of optimism, with many investors and analysts seeing Bitcoin’s breakout as a positive sign for the broader crypto ecosystem.

According to Swissblock analysts, Bitcoin’s move above $53,000 indicates a significant shift in momentum and suggests that the cryptocurrency could continue its upward trajectory. With Bitcoin now breaking out of the range it has been trading in since February 15, analysts believe that “all sails are set” for further gains.

The $58,000 target proposed by Swissblock suggests a bullish outlook for Bitcoin, indicating potential upside for investors in the near term. However, as with any market prediction, it’s essential to consider various factors that could influence Bitcoin’s price movement, including market sentiment, regulatory developments, and macroeconomic trends.

As Bitcoin continues to capture the attention of investors and traders worldwide, its price movements will likely remain a focal point for market participants. Whether Bitcoin can sustain its momentum and reach the $58,000 target remains to be seen, but for now, the cryptocurrency’s breakout has reignited optimism among crypto enthusiasts.

Ethereum

This week, Ethereum finds itself at a critical juncture, currently facing resistance from 2060 to 2150. A decisive close above 2150 could set Ethereum on an upward trajectory, targeting 2500.

On the support side, Ethereum’s primary weekly support rests at 1789, providing a key level to watch. In a downturn, the secondary support is identified at 1544. However, a drop below 1544 could signal a further descent, with the next major support zone at 1373.

Stay tuned for our weekly Ethereum analysis as we monitor these critical levels, providing insights into potential market movements for the week ahead.”