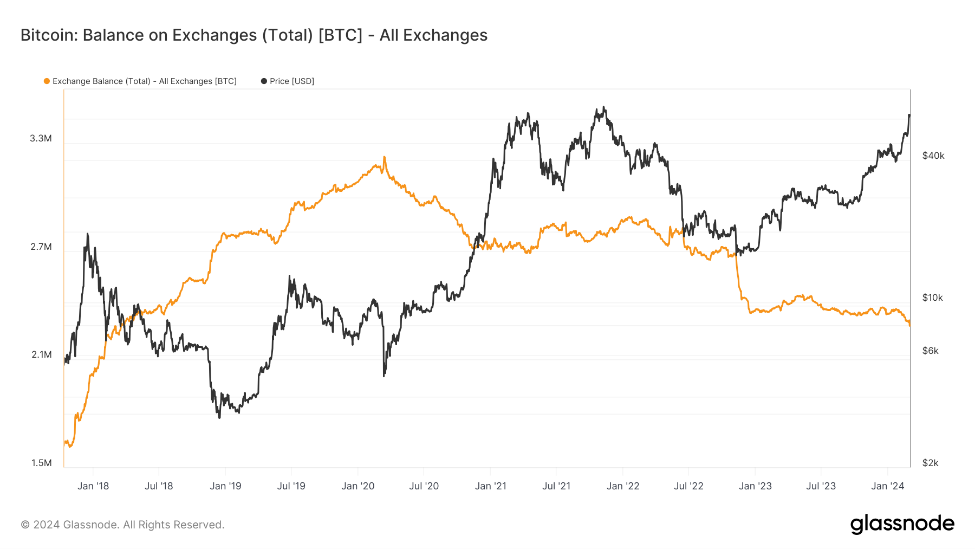

Bitcoin (BTC) is experiencing a rapid exodus from exchanges, reaching levels not seen since mid-2021 and potentially on track to set new historic records in U.S. dollar terms. As BTC price action approaches all-time highs, mainstream investors may not have fully returned to the crypto market, but behind the scenes, Bitcoin exchanges are witnessing significant withdrawals of BTC reserves.

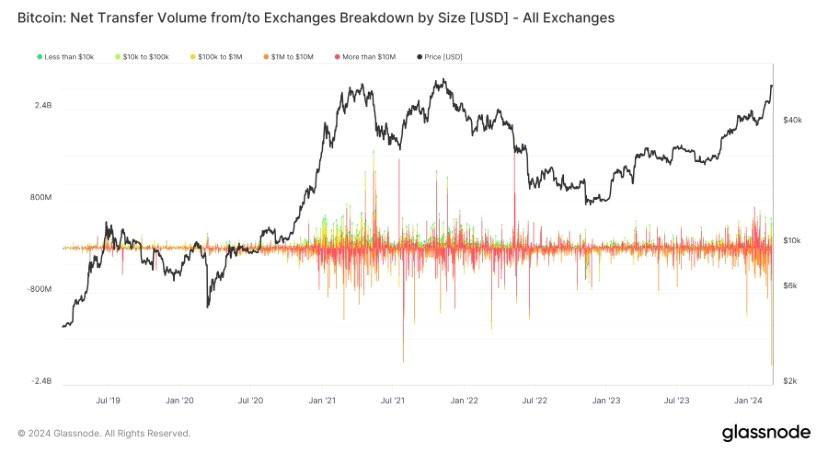

According to James Van Straten, a research and data analyst at crypto insights firm CryptoSlate, multibillion-dollar BTC withdrawals were flagged in a recent post on X on March 3. Data from on-chain analytics firm Glassnode revealed that on March 1 alone, withdrawals totaled around $2 billion, marking one of the biggest withdrawals in over five years.

The role of United States spot Bitcoin exchange-traded funds (ETFs) is also evident, with significant outflows reported from platforms like Binance and Coinbase. Notably, Binance saw approximately $400 million in outflows, while Coinbase handled the rest, excluding about $200 million sent to custodian Coinbase Pro.

As a result of these withdrawals, the total BTC assets available on major trading platforms monitored by Glassnode have declined to the lowest levels since March 2018, when BTC/USD traded at just $8,000.

Simultaneously, changes in Bitcoin market composition suggest the influx of new investors. Data tracking unspent transaction output (UTXO) ages indicates the involvement of more “younger” coins, with previously dormant coins—inactive for six months or more—beginning to move.

According to Crypto Dan, a contributor to on-chain analytics platform CrryptoQuant, this trend suggests that new investors are entering the market, signaling potential for further growth and participation. As the influx of new investors continues and the ratio of “younger” coins rises, the stage may be set for a sustained bullish market trajectory.